Winter Protection Plan

Contact: Your Local Utility Company

The Winter Protection Plan (WPP) protects enrolled seniors and low-income customers from service shut-offs and high utility bill payments during the winter months. If you are eligible, your utility service will remain on (or restored with the WPP) from Nov. 1 through March 31, if you:

pay at least 7% of your estimated annual bill each month, and

make equal monthly payments between the date you apply and the start of the next heating season on any past-due bills.

When the protection period ends (March 31), you must begin to pay the full monthly bill, plus part of the amount you owe from the winter months when you did not pay the full bill. Participation does not relieve customers from the responsibility of paying for electricity and natural gas usage, but does prevent shut-off during winter months. You qualify for the plan if you meet at least one of the following requirements:

- are age 65 or older,

- receive Dept. of Health and Human Services cash assistance, including SSI,

- receive Food Assistance,

- receive Medicaid, or

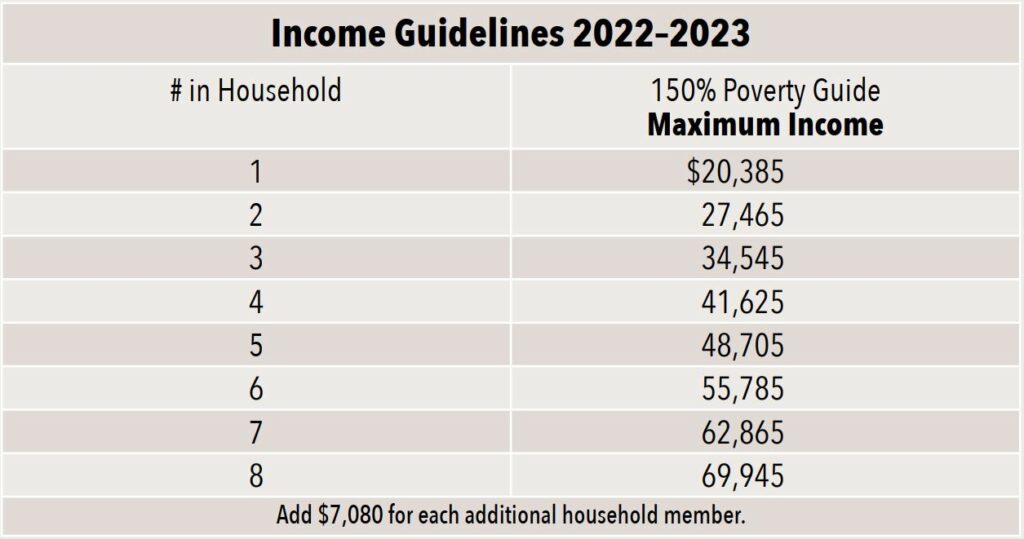

- household income is at or below the 150% of poverty level shown in the Income Guidelines chart above.

Senior citizen customers who participate in the WPP are not required to make specific payments to ensure that their service will not be shut off between Nov. 1 and March 31. Service for seniors can be restored without any payments.

Note: All customers 65+ are eligible regardless of income. Customers are responsible for all electricity and natural gas used. At the end of the protection period, participants must make arrangements with their utility company to pay off any money owed before the next heating season.

Home Heating Credit

Contact: Michigan Dept. of Treasury

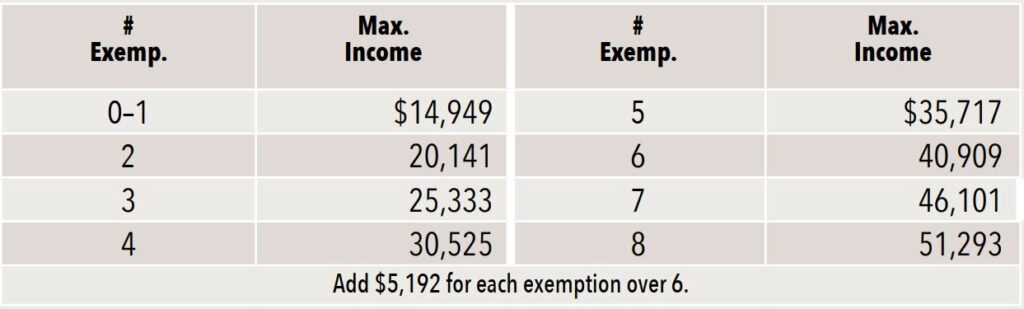

You can apply for a Home Heating Credit for the 2022 tax year if you meet the income guidelines listed above (110% of poverty level) or you qualify based on alternate guidelines including household income, exemptions, and heating costs. Additional exemptions are available for seniors, disabled claimants, or claimants with 5% or more of their income from unemployment compensation.

If you qualify, you may receive assistance to help pay for your winter heating bills. Forms are available mid-to-late January wherever tax forms are provided or from the Michigan Dept. of Treasury (517-636-4486 or michigan.gov/treasury). The Home Heating Credit claim form must be filed with the Michigan Dept. of Treasury no later than Sept. 30 each year.

Earned Income Credit

Contact: U.S. Treasury Dept., Internal Revenue Service, irs.gov/EITC or Michigan Dept. of Treasury, michigan.gov/treasury

The Earned Income Tax Credit (EITC) is a refundable federal income tax credit for low income working individuals and families who meet certain requirements and fi le a tax return. Those who qualify will owe less in taxes and may get a refund. Even a person who does not generally owe income tax may qualify for the EITC, but must file a tax return to do so. If married, you must file jointly to qualify. File Form 1040 or 1040A and attach the EITC.

You may claim a Michigan earned income tax credit for tax year 2021 equal to a percentage of the federal earned income tax credit for which you are eligible.

State Emergency Relief Program (SER)

Contact: Local Michigan Dept. of Health and Human Services (DHHS), michigan.gov/mdhhs

You do not have to be a DHHS client to apply for help with a past-due bill, shut-off notice, or the need for deliverable fuel through the SER. This program, available Nov. 1–May 31, provides most of its utility assistance during this crisis season. However, limited assistance is available outside the crisis season.

If you receive a DHHS cash grant, you may use part of it toward heat and electric bills. Apply online using MI Bridges: Michigan.gov/mibridges.

Low-Income Weatherization Assistance Program

Contact: Local Community Action Agency

You may be able to receive help with weatherizing your home to reduce energy use if you meet low-income eligibility guidelines (200% of poverty guidelines) or if you participate in the Dept. of Health and Human Services Family Independence Program or receive SSI. Weatherization may include caulking, weatherstripping, and insulation. Contact your local Community Action Agency for details. Visit mcaaa.org to find one in your area.

United Way

Contact: Call 2-1-1 or uwmich.org/michigan-211

2-1-1 is a free phone service operating 24 hours daily to provide information about help that may be available in a particular area with utilities and other needs. Dial 2-1-1 or visit mi211.org to find available services.

Medical Emergency Protection

Contact: Local Utility Company

You are protected from service shut-off for nonpayment of your natural gas and/or electric bill for up to 21 days, possibly extending to 63 days, if you have a proven medical emergency. You must provide written proof from a doctor or a public health or social services official that a medical condition exists. Contact your gas or electric utility for details.

Shut-off Protection For Military Active Duty

Contact: Local Utility Company

If you or your spouse has been called into active military duty, you may apply for shut-off protection from your electric or natural gas service for up to 90 days. You may request extensions. You must still pay, but contact your utility company and they will help you set up a payment plan.

Michigan Veterans Trust Fund Emergency Grant Program

Contact: MI Veterans Trust Fund

The Trust Fund provides temporary assistance to veterans and their families facing a financial emergency or hardship, including the need for energy assistance. Contact the Michigan Veterans Trust Fund at 800-642-4838 or michiganveterans.com.

Michigan Homeowner Assistance Fund Administering Agency: Michigan State Housing Development Authority

The MIHAF provides funds to customers with assistance preventing homeowner mortgage delinquencies, defaults, foreclosure, loss of utilities or home energy services, and displacement. Applicants must demonstrate financial hardship directly related to COVID-19 on or after Jan. 21, 2020.

MI Energy Assistance Program

Contact: Utility or 2-1-1 in late November

The Michigan Energy Assistance Program (MEAP) includes services that will enable participants to become self-sufficient, including assisting participants in paying their energy bills on time, budgeting for and contributing to their ability to provide for energy expenses, and being energy efficient. Shut-off protection is provided Nov. 1–April 15 for all residential customers. The MEAP is supported by the state’s Low-Income Energy Assistance Fund (LIEAF). An electric utility that chooses not to collect for the LIEAF shall not shut off service to customers for nonpayment between Nov. 1 and April 15. For a list of electric providers that opt out of collecting the LIEAF, go to michigan.gov/energygrants.